Everybody loves money. We’ll do just about anything to get it. We need it to live.

But what is it, really?

Some dirty paper you wouldn’t touch if it didn’t promise lunch? A number on a screen that jumps around while you sleep?

Somewhere along the line, money took on a god-like quality. But beneath the myth, all it really represents is time. Your time. Someone else’s. All sliced into tokens and traded across systems until we forget what we were actually exchanging.

The Lie That Makes the World Go Round

We like to think we’re trading labor for money. But labor is just structured time.

When you take a job, you’re renting out slices of your existence in exchange for currency. And currency? That’s just a stand-in. A symbol. A delayed receipt for time.

We’ve built so many layers of abstraction between effort and value that we no longer recognize what’s actually being traded.

But the truth hasn’t changed:

Time is the only real currency.

Inflation: The Grand Theft of Human Time

Let’s talk numbers.

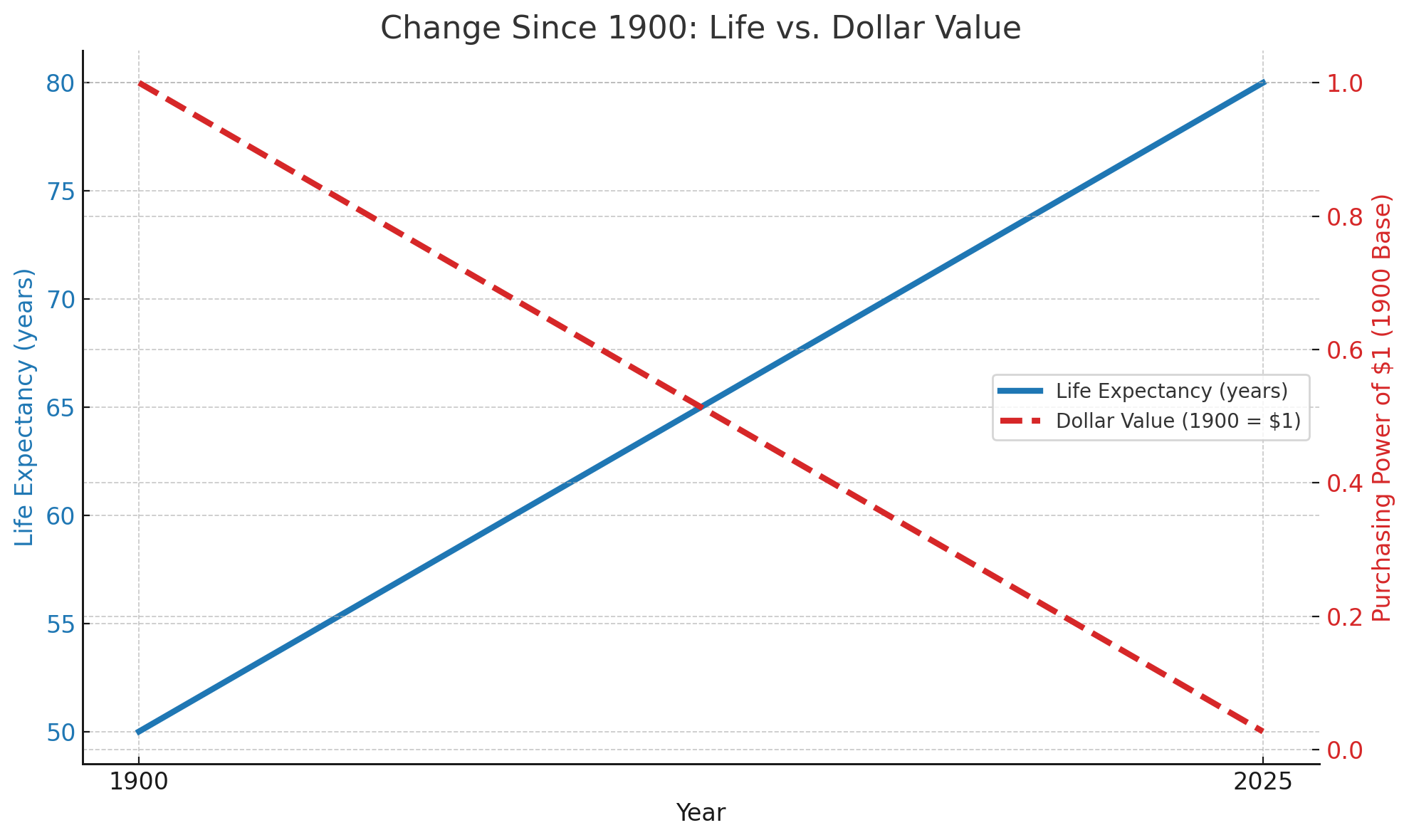

In 1900, the average American lived about 50 years. Today it’s around 80. That’s a 60% improvement.

Sounds great, right?

Now look at purchasing power. A single U.S. dollar in 1900 is worth roughly $37 today. That’s a 3,600% loss in value.

So in 125 years, we’ve gained 60% more life… but lost 3,600% of the purchasing power for that life.

That’s the gap. That’s the pressure. That’s what modern stress is.

Your grandfather worked for $2/hour and bought a house by 25.

You work for $25/hour and can’t afford rent without a roommate and a side hustle.

He’s not wrong to think your wage is higher.

He’s just wrong about what that number means now.

Because inflation doesn’t just move the goalposts, it changes the field, the ball, the rules, and the price of the ticket. And you’re still out there trying to play.

Price Is Fiction, Scarcity Is Real

Ever wonder why a loaf of bread costs $4 and not $40?

Because we all agree it costs $4.

That’s it. That’s the whole trick.

If we devalued the dollar 10x across the board overnight, and everyone’s wages and prices dropped accordingly, the cost of that loaf would fall to $0.40, and nothing would actually change. The baker would still need to wake up, knead dough, and bake the thing. The time is the same.

Currency is fiction. Time is not.

A baker can only bake so many loaves per day. That’s the real constraint. That’s what you’re paying for. Not flour. Not overhead. Not even the flavor. You’re paying for their time, packaged in the form of bread.

Terry Pratchett Was Right

In Making Money, Terry Pratchett’s con man–turned–banker Moist von Lipwig discovers that people are already treating postage stamps like currency, simply because there aren’t enough coins to go around.

So he leans in. Starts printing stamps as money.

And people ask: “How can I trust this paper?”

The answer?

Faith.

All money runs on it. Always has.

But Moist knows what you now know: behind every coin, every bill, every digital transfer, there’s just a limited supply of time.

Once the bread is gone, the game’s over.

OppenFolio as Quiet Protest

I built OppenFolio because I’m lazy. But not lazy as in irresponsible. Lazy as in: I reject the treadmill.

I don’t want to run faster just to stand still.

I don’t want to trade more stress for fewer options.

So I built a machine that turns capital into income, automatically. Not because I want to be rich. Because I want my time back.

OppenFolio might look like some giant machine now. But it didn’t start that way. Just three shares. Bought at $8.18 each. Less than $25 to change the shape of my life.

And that’s the real secret:

You can opt out.

You can live somewhere cheaper.

You can build slowly.

You can stack yield until the yield starts stacking you.

At first, you’ll fantasize about moving somewhere cooler, louder, shinier.

But if you stay the course, long enough to reclaim your time, you’ll find you don’t want to go back.

You’ll realize the expensive places weren’t built for people with time.

They were built for people who’ve forgotten they ever had it.

You can always reach me at [email protected] if you want to go deeper.

Disclaimer: This post is for informational purposes only and reflects personal opinions, not financial advice. OppenFolio is not an investment advisory service. See site disclaimer for full details.