Last time, “Picking Symbols”, we talked about the core of OppenFolio, its fuel rods, which are currently all YieldMax ETFs due to their extreme volatility and leveraged yields. We talked about how those symbols are designed to be burned inside a reactor. They’re too dangerous to hold blindly.

Today we’re talking about the shell I built around that core.

What the Shell Is (and Isn’t)

“Protective” isn’t quite the right word.

Nothing about the shell makes the core less dangerous. Just like a real reactor, touching a fuel rod will kill you, whether or not there’s a shell around it.

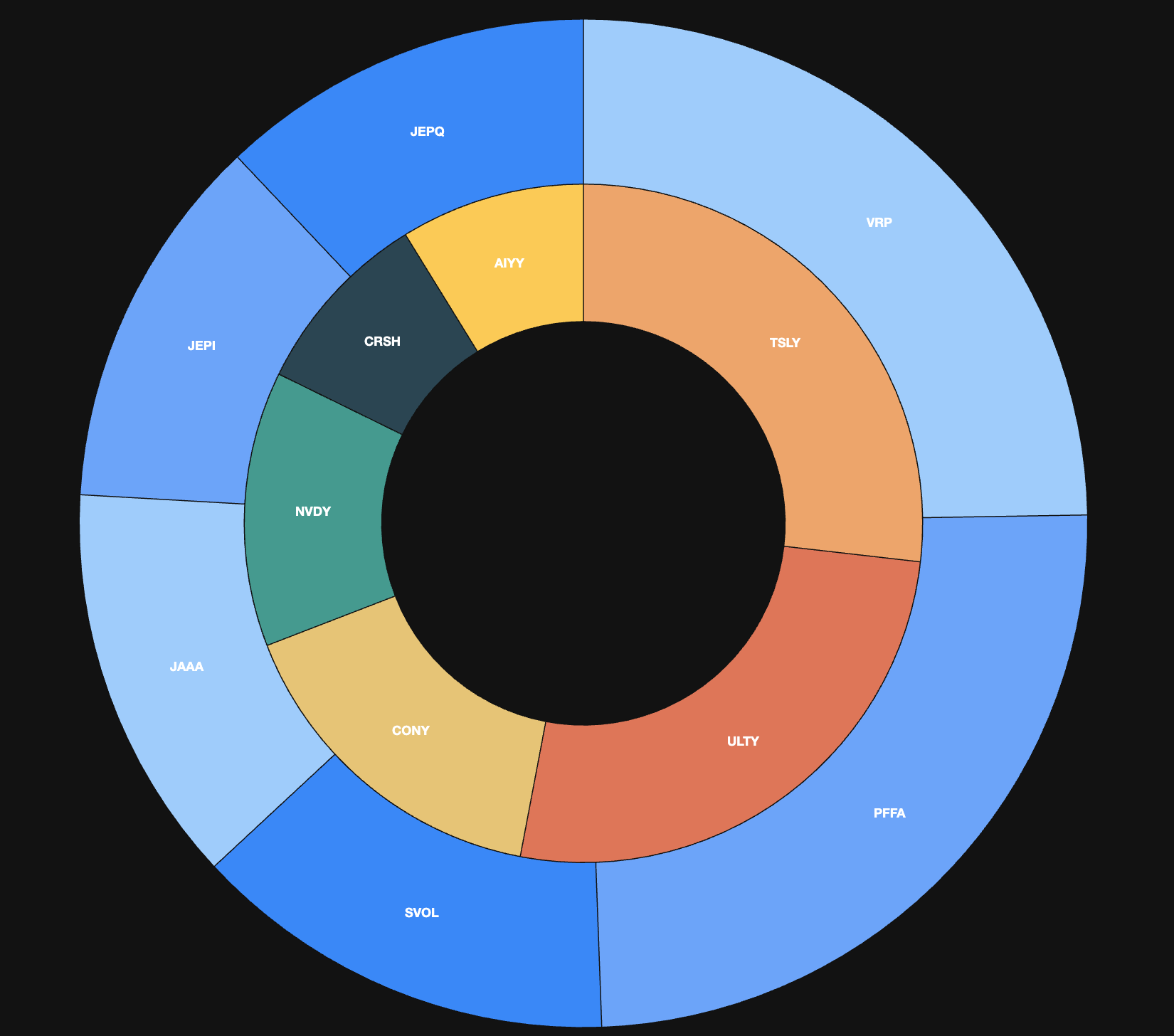

↑ The outer blue ring is the shell. The inner ring is the core.

The shell does not prevent catastrophic events. If, for example, YieldMax were suddenly charged with fraud tomorrow, purely hypothetical, their symbols would crash. The run would be so fast that retail traders like us wouldn’t have time to exit. The result: the core goes to zero.

That’s a grim reality of this strategy. And while it’s unlikely, a lot of things could go wrong that tank the core while also blocking our ability to react.

So what is the shell for?

Its purpose is not prevention. It’s containment. It buys us time. It keeps paying. It gives us liquidity when we need it most.

Black Swans and Rebuilding

People focus on the destruction from black swan events. But they forget:

Those events reprice assets.

If you have dry powder, and a steady income stream, you can often buy symbols at historical lows.

The shell gives us that shot. If there’s any market left standing, and any path to recovery, the shell becomes the way forward. We don’t mourn the core. We expected it to burn. Instead, we take the cash flow from the shell and build a new one.

That’s why we built it boring.

What’s in the Shell?

If you asked your broker to build a high-income retirement portfolio, they’d mention most of these names. And that’s exactly what we want.

They aren’t quite as boring as SCHD or VYM, those don’t pay enough to work here, but they’re still ballast. Here’s the breakdown:

🏦 20% , VRP

- Yield: ~6%

- Expense Ratio: 0.28%

- Payouts: Monthly

- What it is: Variable-rate preferred stock ETF

- Translation: Bank stocks with floating dividends

💼 20% , JAAA

- Yield: ~6%

- Expense Ratio: 0.20%

- Payouts: Monthly

- What it is: Investment-grade CLOs

- Translation: Loans made by those same banks

🧱 20% , PFFA

- Yield: ~10%

- Expense Ratio: 2.5% (active management)

- Payouts: Monthly

- What it is: Preferred stock

- Translation: If the market collapses, we’re first in line (after debt)

Despite the high fee, PFFA barely moves. In a 30% Dow drawdown, it might drop 5%. This thing yawns through chaos.

🧓🏼 10% , JEPI

- Yield: ~8%

- Expense Ratio: 0.35%

- Payouts: Monthly

- What it is: Covered call ETF on S&P 500

- Translation: Steady income, reduced growth, reduced volatility

📈 10% , JEPQ

- Yield: ~11%

- Expense Ratio: 0.35%

- Payouts: Monthly

- What it is: Covered call ETF on Nasdaq

- Translation: Similar idea, just tech-flavored

Why It Works

Together, these five symbols make up 80% of the portfolio and yield around 8% overall. That means about $60/month per $10K invested.

In a bull market, that income is a rounding error. But in disaster modeling, that steady trickle becomes our lifeline. Over 5–6 months, that income is often enough to rebuild a burned core, if the market is on a path to recovery.

Portfolio Ratio: 80/20

Currently, we run 80% shell / 20% core.

That’s a risk decision. If you can handle more heat, go 25% or even 30% core. The yield will spike, but so will the potential for total loss. You need to be truly ready to lose your entire core and rebuild from scratch.

If you aren’t ready for that?

This isn’t the portfolio for you.

OppenFolio really is built like a nuclear reactor. Fuel rods burning at the center. A containment shell stabilizing the fire. And systems in place to handle failure, because failure isn’t a bug. It’s part of the design.

You can always reach me at [email protected] if you want to go deeper.

Disclaimer: This post is for informational purposes only and reflects personal opinions, not financial advice. OppenFolio is not an investment advisory service. See site disclaimer for full details.