Let’s say you have $300K sitting in a taxable brokerage account.

You could try to squeeze income out of it.

Or you could never sell a single share, and still spend money for the rest of your life.

That second path is what this post is about.

Welcome to the Borrower Class

Wealthy people don’t sell assets.

They borrow against them.

They go to their broker, get a margin line or a securities-backed line of credit (SBLOC), and draw cash against their portfolio, usually 20–30% of its value.

That loan doesn’t count as income. So they don’t pay income tax.

And the interest on that loan? Often just 1–3% annually.

So instead of liquidating assets and paying 15–37% in capital gains, they borrow at 2%, keep the compounding going, and live their lives tax-free.

If they play it right, they die before ever repaying the loan.

Their heirs get the assets with a full step-up in basis.

No tax. No clawback. Just clean, generational wealth.

I’d heard about this system before.

What I didn’t fully understand was the part where you don’t actually have to pay the interest from your paycheck.

Wait, You Can Do What?

Some lending structures let you roll the interest into the loan itself, as long as your total loan-to-value ratio stays low enough.

That blew my mind.

You’re borrowing money… to pay the interest… on the money you borrowed… and your broker is fine with it.

It only works because your assets are growing faster than the interest is accruing.

They hold the collateral. They know the math. They’re not worried.

Neither should you be, if you respect the limits.

That’s the part I hadn’t fully internalized:

It’s not about repaying the loan.

It’s about managing the margin ratio and letting time do the work.

Wait, Somebody Has to Pay That Loan Off, Right?

Yes, eventually. In this case, “eventually” is designed to be the day after you die.

Morbid? Sure.

But it works.

You spend your life drawing tax-free cash from your growing portfolio, keeping the loan-to-value ratio below, say, 30%. You never pay the principal. You don’t even pay the interest.

Then one day, you die.

Your estate uses a portion of your assets to settle the loan. Because you kept your LTV conservative, less than half your portfolio gets liquidated to cover your entire lifetime of spending.

The rest? It gets a step-up in basis. Its taxable history is erased. Your heirs inherit it clean.

Then they do it again.

This is how generational wealth actually works.

Not by hoarding, but by understanding the rules of the game.

But What About OppenFolio?

Here’s the kicker. You could do all that borrowing magic and still… keep OppenFolio running.

Why?

Three reasons.

1. It’s fun.

Not emotionally or spiritually. But mechanically.

Building a machine that emits money is satisfying in the way growing basil in a windowsill is satisfying.

It’s controlled. It’s self-contained. It feeds you.

OppenFolio gives you frequent dopamine hits. Monthly deposits. Real numbers you can watch in real time.

You could turn it off. But you won’t. Because you like it.

2. You might still need income.

Not every broker lets you roll interest into principal.

Not every estate plan is airtight.

Not every future goes to plan.

Sometimes you want to make a purchase without increasing your loan.

Sometimes you just want income that feels like income.

OppenFolio provides that stream, even if it’s not the most elegant part of the system.

It’s the backup generator. The auxiliary engine. The reactor’s second core.

It buys you flexibility.

And peace of mind.

3. It’s Free Real Estate. I Mean… Income.

Here’s where it gets spicy.

If you borrow against your portfolio and use that money for personal expenses, the interest isn’t tax-deductible. That’s just the cost of doing business as a rich person.

But if you reroute that borrowed money into more investments, like, say, a carefully engineered yield machine built from high-distribution ETFs, then suddenly the interest can become deductible.

That’s the IRS rule:

Investment interest is deductible if the loan was used to buy investments that produce taxable income.

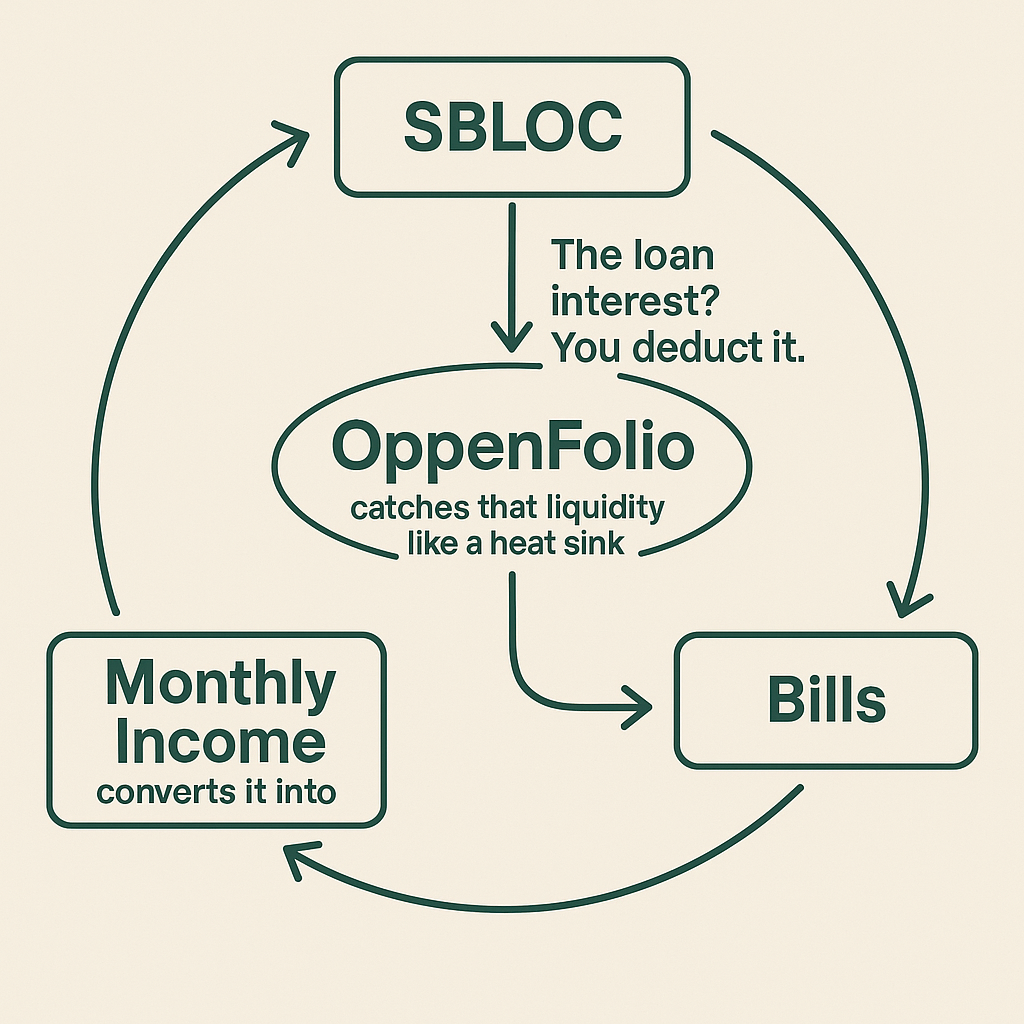

So now you’ve got a closed-loop machine:

- SBLOC provides the liquidity

- OppenFolio catches that liquidity like a heat sink

- It converts it into monthly income

- That income pays your bills

- And the loan interest? You deduct it.

It’s a tax loop.

Legal. Boring. Beautiful.

You didn’t earn income.

You borrowed.

You invested.

You paid interest.

And then you deducted it.

You created an income stream that technically isn’t income.

The IRS sees it. It shrugs. It moves on.

This is the part of the system where OppenFolio stops being just a dividend printer and becomes a regulatory pressure valve.

It doesn’t just smooth cash flow.

It stabilizes the whole tax load.

And yeah, you might still owe something if your net investment income exceeds your deductible interest, but that’s future-you’s problem. And future-you has options.

How Much Do You Really Need?

This is a game for wealthy people. 300K can get you started, but if you keep loan-to-value at 30%, that only gives you around $70–80K of usable borrowing capacity. Let’s break it down.

If you borrow against a $300K portfolio at a conservative 25–30% loan-to-value (LTV), that gives you $75K–$90K of total borrowing power.

Sounds like a lot, but it’s not renewable. If your portfolio grows at 8% annually, and your loan interest is 2%, your net growth is about 6%. So in year two, your portfolio is up to ~$318K, and your new borrowing capacity rises by… maybe $5K.

That’s not enough to live on. So unless you can survive on $5K a year and a dream, you need more scale.

Reverse the Math

Instead of starting with your portfolio, start with your lifestyle.

Let’s say you want to safely pull $100K per year using this strategy.

Since you’ll only access about 5–6% of your portfolio annually (via margin and net growth), you need:

$100K ÷ 0.06 = $1.67 million

Round up for volatility, and you’re looking at:

✅ $2 million in liquid, invested assets

That’s the target. At that level, you can:

- Borrow $500K at 25% LTV

- Let $1.5M continue compounding

- Pull $100K a year tax-free

- Roll the interest into principal

- Die someday, and leave it all behind clean

So What’s the Right Move?

If your broker lets you borrow at 2% and your assets grow at 8%, you’re already winning.

If you never sell and never trigger taxes, you’re playing a game most people don’t even know exists.

If you can do all that and still collect $1,500/month from a data-driven income machine in the corner of your financial room?

You’ve built a system.

Not just to survive, but to move freely.

So yeah, I’m rolling some interest into principal now.

And yeah, OppenFolio is still running.

Because one system gets me leverage.

And the other gets me lunch.

You can always reach me at [email protected] if you want to go deeper.

Disclaimer: This post is for informational purposes only and reflects personal opinions, not financial advice. OppenFolio is not an investment advisory service. See site disclaimer for full details.