Do you think you can time the market?

The honest answer separates two kinds of investors.

Bob buys steadily, week after week, no matter what the market’s doing. He doesn’t overthink entry points. He just follows the plan, trusting that time and compounding will smooth the rough edges.

Alice, on the other hand, waits for the perfect moment. She studies the charts, watches for red days, and only buys when the market dips. Her logic is sound: why pay full price when you can wait for a sale?

In theory, Alice should win.

In practice, she rarely does.

The Habit I Had to Break

For years, I tried to be Alice.

Not literally, but in spirit, the kind of investor who waits for the perfect red day before hitting buy. I’d open my portfolio, see the line down two percent, and tell myself I was being smart: “Now’s the time.” When markets were flat or drifting upward, I’d wait, convinced patience would be rewarded.

Sometimes it was.

Mostly, it wasn’t.

Because while I was waiting for perfection, Bob was already compounding.

The Siren Song of the Dip

It’s a comforting myth: the idea that if you can just be a little more disciplined, a little more patient, you’ll catch the dips and build a stronger portfolio. In theory, it even works. In a perfectly simulated world, with perfect execution, Alice wins.

We proved it.

In our first test, Alice only bought after a −2% weekly drop. She got all the best prices, deployed all the same capital as Bob, and ended slightly ahead.

But that wasn’t realism. That was a trading god scenario, Alice with flawless reflexes and zero hesitation. In practice, humans don’t buy exactly at the bottom. We hesitate, or we jump too early, or we wait too long.

So we made her human.

ULTY: A Real-World Test Case

Let’s take a real example: ULTY, one of Oppenfolio’s core high-yield positions.

- It trades around $5–6.

- It pays a bi-weekly distribution, 26 times per year.

- Its trailing 90-day yield is about 17%, meaning it paid that much in just the past three months, real data from the live Oppenfolio.

- Annualized, that’s roughly 68%, or about 2.6% every two weeks.

That frequency matters.

If you sit out a single two-week cycle waiting for a “better entry,” you give up 2.6% of yield, and the compounding on it.

Here’s what that looks like:

| Scenario | Buy Price | Missed Cycles | Yield Missed | Net Effect After 3 Months |

|---|---|---|---|---|

| Bob (buys now) | $5.50 | 0 | 0% | Full 17% yield compounding |

| Alice (waits 2 weeks, buys at $5.40) | $5.40 | 1 | −2.6% yield | Entry gain offset by lost payout |

| Alice (waits 4 weeks, buys at $5.30) | $5.30 | 2 | −5.2% yield | Lost yield overwhelms price gain |

Yield compounds faster than luck. Missing even one or two cycles can erase the small advantage of a lower entry.

The Simulation: Bob vs. Alice on ULTY

We modeled this out using ULTY’s real-world behavior.

Both Alice and Bob had the same total capital and received the same bi-weekly 2.615% distribution, automatically reinvested.

- Bob bought $500 every week, no timing, no emotion.

- Alice waited for weeks when the price dropped at least −2%, then deployed her accumulated cash.

Her timing wasn’t perfect:

30% of the time she was a week early,

35% a week late,

20% two weeks late,

and only 15% perfect.

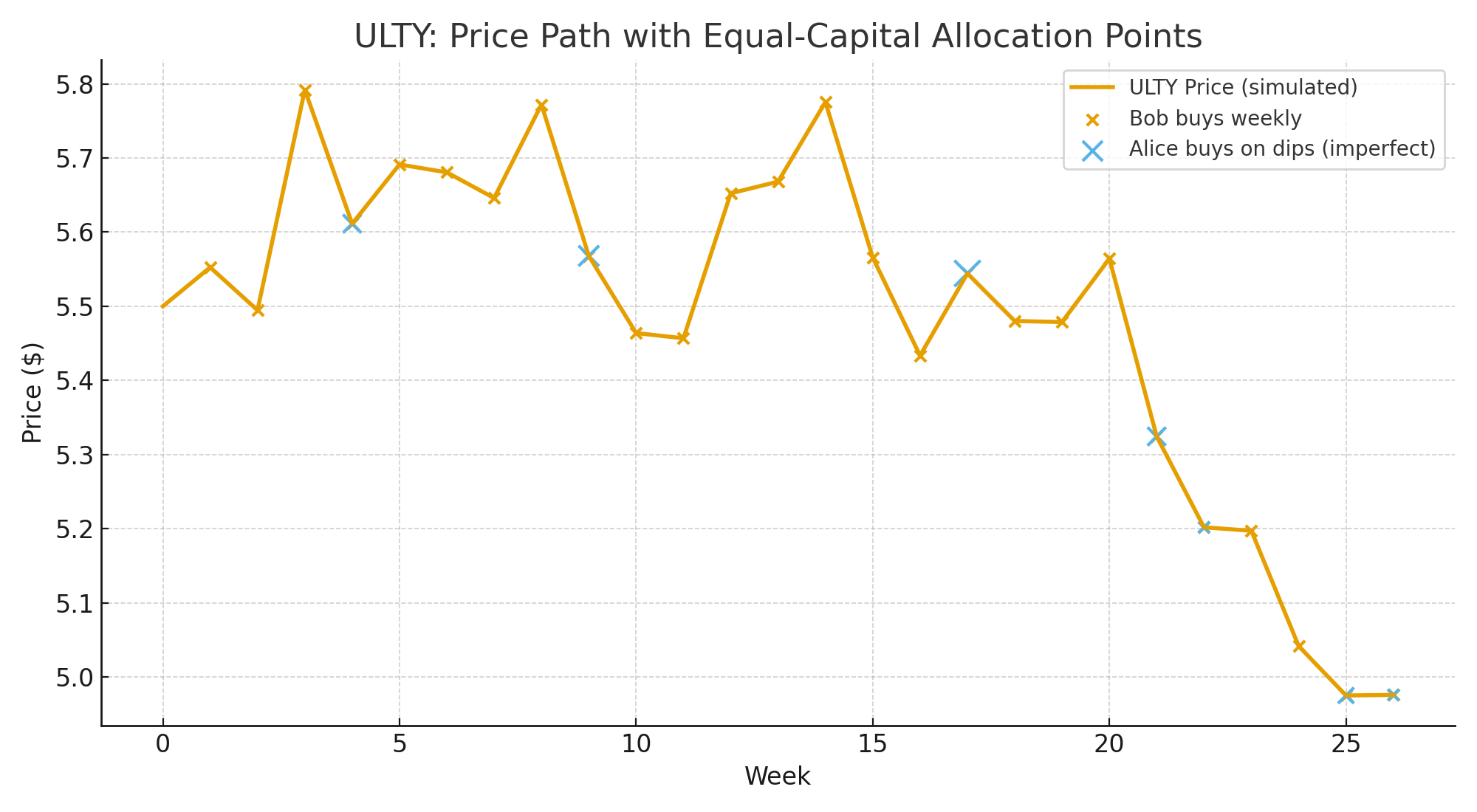

Here’s what that looked like in one 26-week run:

Figure 1: Price Path with Allocation Points. Bob (orange dots) buys every week. Alice (blue Xs) waits for −2% dips, showing how her imperfect timing makes her buys less consistent and often delays capital deployment.

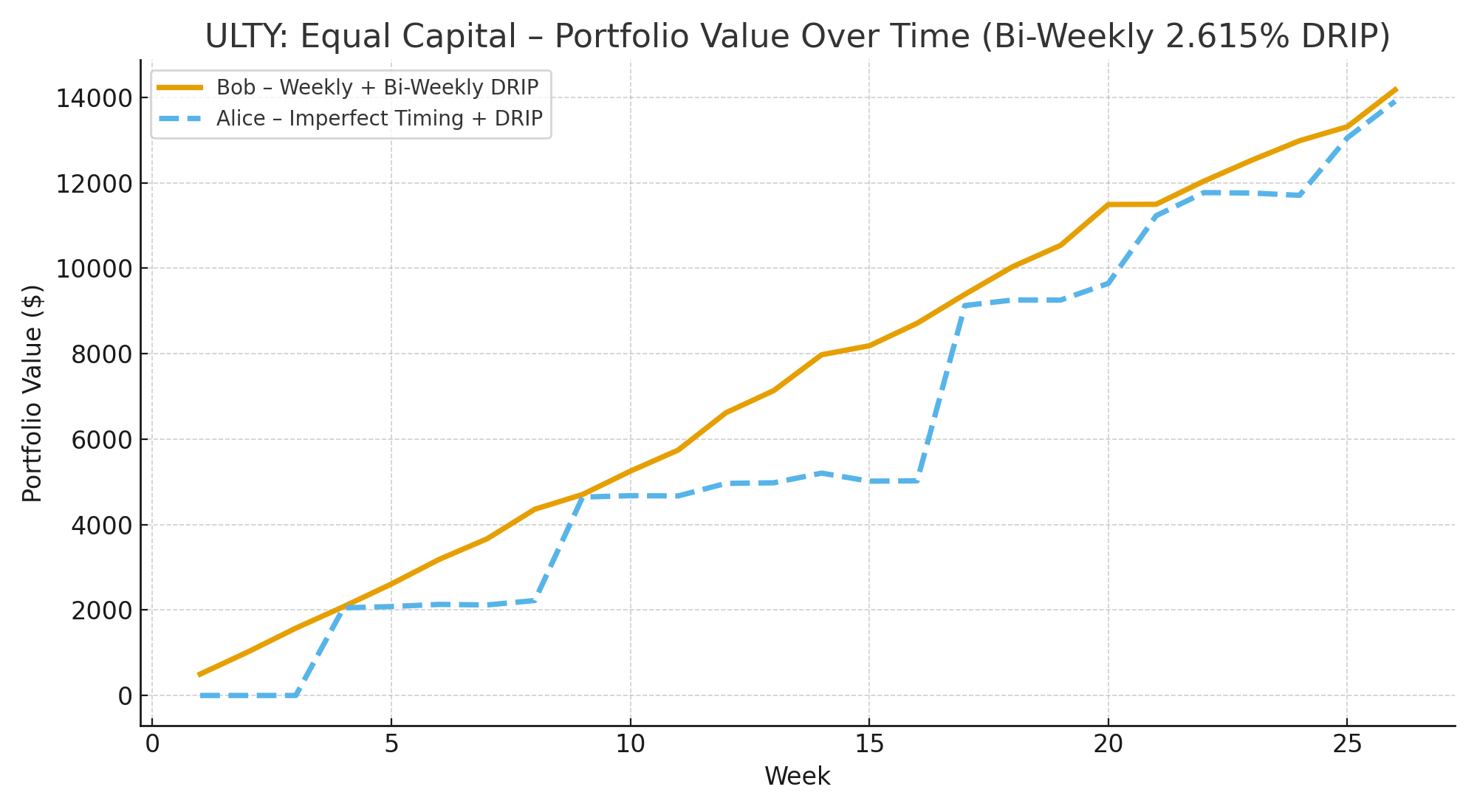

And here’s how their portfolios grew:

Figure 2: Portfolio Value Over Time. Despite buying at a slightly higher average price, Bob’s steady weekly accumulation and uninterrupted bi-weekly compounding (solid gold line) allowed his portfolio to pull ahead of Alice’s (dashed blue line) by the end of the 26-week period.

Despite Alice’s lower average cost, Bob’s portfolio grew faster, because every two weeks, he captured another payout.

Alice, waiting for dips, sat out several cycles that could never be recovered.

Consistency Is the Winner

When we ran the same simulation 400 times across randomized ULTY-like price paths, Bob finished ahead in roughly two-thirds of all cases.

Alice still won in about a third, when volatility lined up perfectly with her buys, but her edge was unpredictable and impossible to reproduce.

Bob’s edge was small but consistent.

He always compounded, and compounding is what wins over time.

Bob’s story isn’t about getting rich quick; it’s about being reliably right.

The Real Lesson

If Alice could hit every dip perfectly, she would win.

That’s not wrong, it’s just irrelevant.

Perfect execution isn’t a strategy. It’s a coincidence.

Oppenfolio was never designed for luck. It was designed for continuity, for the quiet rhythm of capital entering the system week after week, compounding every payout without hesitation or heroics.

That’s what Bob does.

And that’s what works.

So I stopped trying to be Alice.

Now I just show up like Bob.

Methods

Simulation parameters:

- Equal total capital ($500 weekly × 26 weeks).

- ULTY-like price behavior: $5–6 range, 2% weekly volatility, mild upward drift.

- Bi-weekly yield of 2.615% (≈68% annualized) reinvested every payout cycle.

- Alice’s dip rule: buys on −2% weeks with human timing jitter (−1 to +2 weeks).

- 400 randomized Monte Carlo paths.

Across all runs, Bob (steady cadence) outperformed Alice (imperfect dip timing) in roughly two-thirds of cases, confirming that consistent exposure beats inconsistent precision.

You can always reach The Architect at [email protected] if you want to go deeper.

Disclaimer: This post is for informational purposes only and reflects personal opinions, not financial advice. Oppenfolio is not an investment advisory service. See site disclaimer for full details.